In the cosmeceutical industry, managing supply deals effectively is crucial for maintaining a healthy business ecosystem. Delinquent accounts can disrupt the flow of goods, strain relationships, and impact financial stability. This article delves into the various aspects of handling delinquent accounts in cosmeceutical supply deals, from understanding the root causes of payment issues to implementing strategies for prevention and effective communication. We also explore legal avenues for resolution and analyze case studies to extract industry best practices. The goal is to equip stakeholders with the knowledge to approach delinquent accounts proactively and maintain robust supply chain operations.

Key Takeaways

- Recognizing the common causes of payment delays is essential for preventing and managing delinquency in cosmeceutical supply deals.

- Proactive credit management policies and enhanced communication between suppliers and customers can mitigate the risk of account delinquency.

- Maintaining professionalism and employing strategic negotiation techniques are key to resolving payment issues with delinquent clients while preserving business relationships.

- Legal actions, such as litigation and engaging debt collection agencies, are options to consider when other methods of resolution fail.

- Analyzing case studies and adopting industry-wide standards can provide valuable insights into best practices for managing delinquent accounts in the cosmeceutical sector.

Understanding the Nature of Delinquency in Cosmeceutical Supply

Identifying Common Causes of Payment Delays

In the cosmeceutical industry, payment delays can stem from a variety of sources. Cash flow issues often top the list, as clients may struggle with their own receivables. Miscommunication or disputes over supply quality and terms can also lead to stalled payments.

Invoice discrepancies are another common culprit, where errors or unclear charges prompt clients to withhold payment until resolved. Economic downturns or shifts in market demand can unexpectedly affect a client’s ability to pay on time.

- Cash flow challenges

- Miscommunication or disputes

- Invoice discrepancies

- Economic fluctuations

Timely identification and understanding of these causes are crucial for proactive account management and maintaining a healthy business relationship.

Assessing the Impact of Delinquency on Supply Chains

Delinquency in payments can ripple through the cosmeceutical supply chain, causing disruptions far beyond a single invoice. Inventory shortages, delayed product launches, and strained manufacturer relationships are just the tip of the iceberg.

Cash flow is the lifeblood of any business, and when it’s interrupted, the consequences can be severe. A domino effect ensues, impacting not just the immediate parties, but also downstream entities reliant on timely deliveries.

- Increased Costs: Handling delinquent accounts often leads to additional administrative costs.

- Supplier Distrust: Repeated delays can erode trust between suppliers and customers.

- Market Instability: The uncertainty of payment can lead to market volatility, affecting pricing and availability.

Delinquency doesn’t just affect the bottom line; it threatens the very stability of supply networks.

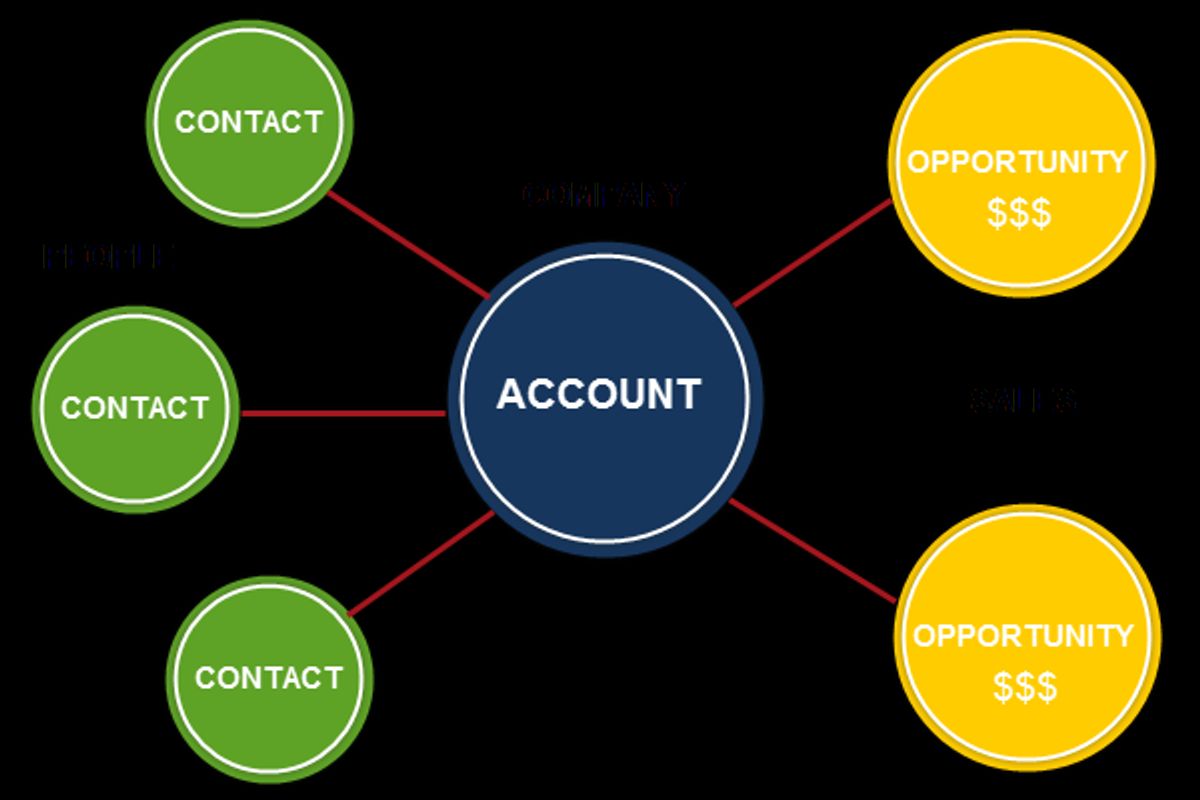

Navigating unsettled accounts is crucial for business success, integrating robust accounting systems, negotiation skills, and technology to prevent payment issues and maintain relationships.

Legal Considerations in Delinquent Accounts

When cosmeceutical supply deals go awry, legal considerations become paramount. Navigating the legal landscape requires a keen understanding of the contracts and laws governing such transactions.

Delinquency in payments can trigger a series of legal actions, each with its own implications for both supplier and customer. It’s essential to be aware of the rights and remedies available under the law:

- Reviewing the contract terms for breach conditions

- Understanding statutory rights and obligations

- Considering the enforceability of security interests

The goal is to resolve disputes amicably, but preparedness for legal recourse is a must.

Timely legal counsel can prevent escalation and aid in the recovery of debts. It’s not just about being right, but also about being smart in the approach to delinquent accounts.

Strategies for Preventing Delinquent Accounts

Implementing Robust Credit Management Policies

To safeguard against financial risk, cosmeceutical suppliers must establish strong credit management policies. These policies serve as the backbone of a company’s defense against delinquency, ensuring that credit is extended responsibly and with due diligence.

Credit assessment is a critical step in this process. By evaluating the creditworthiness of potential clients, suppliers can set appropriate credit limits and payment terms. This proactive approach minimizes exposure to bad debt and maintains cash flow stability.

- Credit Application: Mandatory for all new clients.

- Credit Checks: Conducted regularly to monitor changes in credit status.

- Credit Limits: Set based on client’s financial health.

- Payment Terms: Clearly defined and communicated.

A robust policy not only prevents delinquency but also positions a supplier as a credible and professional partner in the industry.

By implementing these measures, suppliers can significantly reduce the incidence of late payments and the administrative burden of chasing delinquent accounts.

Enhancing Supplier-Customer Communication

In the cosmeceutical supply industry, clear and consistent communication is the cornerstone of preventing account delinquency. Frequent, transparent interactions foster trust and enable early detection of potential payment issues.

Proactive communication strategies include regular payment reminders, updates on account status, and open channels for customer inquiries. This approach not only mitigates risks but also demonstrates a commitment to partnership and customer service excellence.

- Establish clear communication protocols

- Schedule regular financial reviews

- Provide multiple contact points

- Offer flexible communication platforms

By prioritizing communication, suppliers can navigate the complexities of payment cycles and maintain healthy customer relationships.

A robust online presence is also vital. A well-designed website can offer resources and guidance for clients, especially small beauty firms, facing financial challenges. Features such as menu options, newsletter subscription, and easy access to support can enhance the customer experience and prevent delinquency.

Utilizing Technology for Payment Monitoring

In the fast-paced world of cosmeceuticals, keeping a vigilant eye on payments is crucial. Technology plays a pivotal role in this arena, offering tools that automate and streamline the monitoring process. By implementing software solutions, businesses can detect late payments swiftly and accurately.

- Automated alerts for upcoming and missed payments

- Real-time financial dashboards

- Integration with accounting systems

Embrace technology to maintain a steady cash flow and mitigate the risks associated with delinquent accounts.

The use of technology not only enhances efficiency but also provides valuable data analytics. This insight allows for proactive measures, ensuring that minor payment issues don’t escalate into significant financial setbacks.

Effective Communication with Delinquent Clients

Establishing a Professional Dialogue

When addressing delinquent accounts, the cornerstone is effective communication. It’s essential to approach the conversation with clarity and professionalism, ensuring that both parties understand the gravity of the situation.

Dialogue is not just about talking; it’s about listening and understanding the client’s perspective. This can lead to insights into the reasons behind the delinquency and help in formulating a mutually beneficial resolution.

- Begin with a clear agenda

- Maintain a calm and respectful tone

- Be prepared to offer solutions

Remember, the goal is to resolve the issue amicably and maintain a positive business relationship.

By establishing a professional dialogue, you pave the way for payment plans and settlements that are realistic and sustainable. Proactive strategies like these not only prevent delinquency but also foster trust, which is invaluable in the cosmeceutical supply industry.

Negotiation Techniques for Payment Resolutions

Negotiating with delinquent clients requires a blend of firmness and flexibility. Document all communication to maintain a clear record of interactions. Open dialogue is essential; it helps in understanding the client’s position and in expressing your expectations. If disputes arise, mediation may be a constructive path forward.

- Assess the client’s financial situation

- Communicate openly about the debt

- Set clear terms for a payment plan

Establishing a payment plan is a critical step. It should be realistic, reflecting the client’s ability to pay, while also protecting your company’s interests.

Remember, the goal is to achieve a resolution that allows for the recovery of funds while preserving the business relationship.

Maintaining Relationships While Managing Delinquency

In the delicate balance of managing delinquency, maintaining relationships is key. A focus on trust, transparency, and open communication can preempt many issues before they escalate.

- Approach with empathy, understanding the client’s situation.

- Provide clear, consistent payment options.

- Keep records of all interactions and agreements.

While addressing delinquency, never compromise on professionalism. A respectful demeanor ensures a constructive atmosphere for negotiation.

Remember, a strategic approach to delinquency can fortify financial security and bolster customer retention. It’s not just about recovering funds; it’s about sustaining a partnership that can weather financial ebbs and flows.

Legal Remedies and Debt Collection

Exploring Litigation as a Last Resort

When all other avenues have been exhausted, litigation stands as the final barrier to unresolved financial disputes in the cosmeceutical industry. It’s a step taken with caution, as the costs and time involved are significant. Engaging in mediation or arbitration before stepping into the courtroom can often save resources and preserve business relationships.

- Understand the legal framework

- Consider mediation or arbitration

- Assess the cost-benefit ratio

Litigation should be approached as a strategic decision, not an emotional reaction. The goal is to recover debts without damaging the brand’s reputation or future business opportunities.

Effective management of accounts receivable, through technology such as automated billing and data analytics, is crucial for preventing such drastic measures. These tools can provide early warning signs and facilitate swift action to mitigate delinquency risks.

Engaging with Debt Collection Agencies

When internal efforts to reclaim debts prove insufficient, cosmeceutical suppliers may turn to debt collection agencies. These specialized entities are adept at recovering funds while adhering to legal and ethical standards. Selecting the right agency is crucial; it can mean the difference between salvaging a relationship and losing a client.

- Evaluate agency track record and methods

- Ensure compliance with industry regulations

- Discuss clear communication protocols

Engaging with a collection agency should be a structured process, with clear objectives and expectations set from the outset.

Remember, the goal is not just to recover funds, but to do so in a manner that preserves the dignity of all parties involved and maintains the possibility of future business.

Understanding Bankruptcy Proceedings in the Cosmeceutical Industry

Bankruptcy is a critical juncture for cosmeceutical companies facing insurmountable debt. Navigating these proceedings requires a keen understanding of legal frameworks and the implications for all parties involved. The process often involves multiple stakeholders, including creditors, suppliers, and customers, each with their own interests.

Bankruptcy can be a complex maze, but it’s essential to recognize its potential to either provide a fresh start or signify the end of the line for a business. Companies must weigh the benefits of reorganization against the finality of liquidation.

- Step 1: Filing a petition for bankruptcy

- Step 2: Automatic stay of collection activities

- Step 3: Assessment of assets and liabilities

- Step 4: Development of a reorganization plan or liquidation

- Step 5: Confirmation and implementation of the plan

The goal is to emerge leaner, more focused, and with a sustainable financial structure.

DCI, a Cosmetics Industry Debt Collection Agency, offers tailored solutions for efficient debt recovery in the Beauty and Cosmetics industry. Their expertise can be invaluable during the restructuring or wind-down phases of bankruptcy.

Case Studies and Industry Best Practices

Analyzing Successful Account Rehabilitation

Successful account rehabilitation hinges on strategic intervention and tailored recovery plans. Timely action is critical to reversing delinquency trends.

- Review account history and payment patterns

- Engage in proactive communication with the client

- Develop a customized payment plan

- Monitor adherence to the new terms

Consistent follow-up ensures accountability and reinforces the importance of meeting financial obligations.

By analyzing past successes, companies can identify effective strategies for mitigating risk and promoting financial health. This not only recovers funds but also salvages valuable business relationships.

Learning from Past Delinquency Scenarios

Historical data on delinquency in the cosmeceutical industry reveals patterns and solutions. Analyzing case studies helps identify effective strategies and avoid repeating mistakes. Key takeaways include the importance of clear contract terms and proactive communication.

Rehabilitation of delinquent accounts often hinges on understanding the unique circumstances of each case. Tailored approaches can lead to successful recoveries, reinforcing the value of flexibility in financial dealings.

- Review contract terms and conditions

- Monitor payment behaviors

- Engage in early intervention

- Offer structured payment plans

The right blend of firmness and understanding can transform a delinquent account into a reliable business partner.

Learning from the past is not just about rectifying errors; it’s about strengthening future transactions. By incorporating lessons learned into new policies and practices, companies can minimize the risk of account delinquency.

Adopting Industry-Wide Standards for Account Management

The cosmeceutical industry is recognizing the need for uniform account management standards. Consistency across companies ensures a level playing field and fosters trust within the supply chain. Embracing technology is pivotal for efficient accounting and monitoring of transactions.

- Development of shared credit policies

- Standardized payment terms and conditions

- Regular industry-wide financial health checks

By adopting common standards, businesses can streamline operations, mitigate risks, and enhance overall financial stability.

The integration of legal frameworks into these standards is crucial. It provides clarity in dispute resolution and sets clear expectations for managing unsettled accounts. The key takeaways for the industry include improved supply chain management, robust accounting practices, and effective communication strategies.

Dive into our comprehensive ‘Case Studies and Industry Best Practices’ section to explore how our expert debt collection services have empowered businesses in the Beauty & Cosmetics industry. Each case study showcases our commitment to delivering customized solutions that drive results. Don’t miss out on the opportunity to enhance your debt recovery strategies. Visit our website and request a personalized quote today to see how we can tailor our services to meet your unique needs. Your information is secure with us, and our team is ready to provide you with competitive, detailed assistance.

Frequently Asked Questions

What are common causes for payment delays in cosmeceutical supply deals?

Common causes include financial difficulties, disputes over product quality or delivery terms, misunderstandings in payment agreements, and administrative errors.

How does delinquency affect the cosmeceutical supply chain?

Delinquency can disrupt cash flow, strain supplier-customer relationships, and cause inventory shortages, potentially leading to a ripple effect throughout the supply chain.

What legal considerations should be taken into account for delinquent accounts?

Legal considerations include understanding contract terms, potential interest and penalties for late payments, and the legal process for debt recovery or litigation.

How can cosmeceutical companies prevent delinquent accounts?

Preventative measures include implementing strict credit management policies, improving communication with customers, and using technology to monitor payments and credit risks.

What are some effective negotiation techniques for resolving payment issues with delinquent clients?

Effective techniques include offering payment plans, understanding the client’s financial situation, maintaining a professional tone, and finding mutually beneficial solutions.

What should companies know about engaging with debt collection agencies in the cosmeceutical industry?

Companies should understand the agency’s collection methods, fees, and success rates, as well as the legal implications and impact on customer relationships before engaging their services.